Technology Predictions – Winter 2026

This post is part of a series where I talk about technologies and make guesses about how they’ll deliver value in the future.

One of my goals in life is to be a great technologist – an expert at identifying technology that can deliver value and improve the human condition. I hope that writing this blog series and reviewing what I write will help me with that.

Updates Since Last Time

Winter 2025 was my most recent post in this series. I don’t expect everything I write about in this series to change in so short a period. Things that matter tend to take a decade or more to be proven right or wrong. That said, I’d like to get in the habit of checking in to see if my previous statements are revealing themselves correct or if there are things to learn from.

- Foundation models – I argued a year ago that we’d see commoditization here. This year has backed that trend as the leader on any given day tends to spend less time on top for more money as consumers show a willingness to switch and we find there are very few moats.

- The United States – a year ago I wrote “I suspect the next wave it is just as likely to come from Zhengzhou as it is from a place in the United States.” Since then we saw Trump institute (attempted to institute?) a $100k H-1B fee, which I suspect will only accelerate that trend. My reasoning is simple, I believe disruptive development is more likely to come from a generation living in a space that is dense with a builder’s culture and which has a lot of access to investment and skill. The children of people coming to America on H-1B visas match that pattern and it seems our country will now have fewer of them. I think that is bad for America’s future. Some ~70% of H-1B beneficiaries came from India, and so my guess is America just scored an own goal on letting India shift from a net exporter of tech talent to a long term hub for it. I’ve noticed a trend of more expats moving back to India and fewer coming to the United States in the first place. That shift will likely take 25-50 years to be felt, but Bengaluru is now on my list of places likely to be the tech center of the world in 2050-2100.

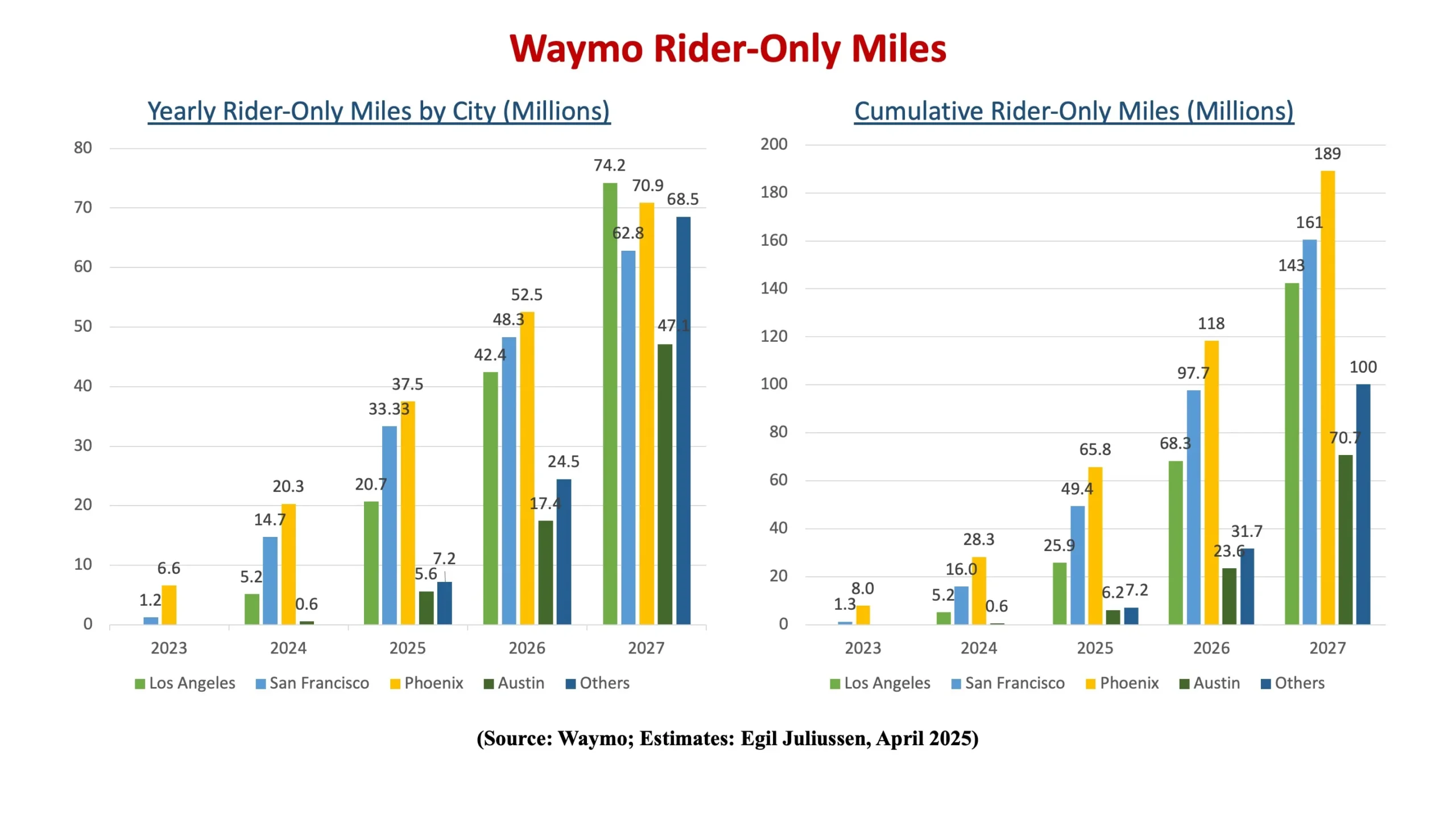

- Autonomous Driving – It seems like we have come out of the popular opinion winter on this technology as Waymo expands its footprint and logs hundreds of millions of miles of driverless taxi rides in San Francisco, Phoenix, Los Angeles and Austin, with more to come. I had this tech as appropriately valued but I think we might now be overvaluing the tech based on the unit economics. I’m leaning towards overvalued as I hear they are presently trying to secure a $100B valuation. My guess is they are struggling because of the financials. Their balance sheet likely looks intimidating.

- AGI – the AI hype likely hit its peak and folks are waiting for a bubble pop. That likely means we have some more time before the bubble pops. I suspect we’re dealing with something more like 2021’s SaaS revaluation than 2001’s internet bubble. Perhaps I’m misunderstanding how wide reaching the speculation is.

- Generative AI – I had called out Godaddy’s website builder as a use case that seemed perfect for generative AI to have a positive business impact. I think we’re seeing hints of that trend come out of Lovable (note, my employer that I hold stock in is an investor in Lovable). It seems they are mostly monetizing the compute used in creation and exploration, and competing with design tools like Figma or Adobe, but I think there is an opportunity for them on the hosting side. That revenue is stickier.

Tech I think is undervalued

- AI-native companies – companies who solve an old problem in a new way that is only now possible with new technology. Think of how Amazon changed how we bought books (and then everything else)

-

- Perhaps I am not looking hard enough, but I’m not seeing many of these. Perhaps it is too easy to capture the value from within the existing companies. Perhaps it just takes more time to see it.

- I would expect us to see the greatest chance for disruption in some business that was asset-light and relied on a lot of people that took some effort to train in a specific or even proprietary manner. A small management team could build this company from scratch with an agent workforce.

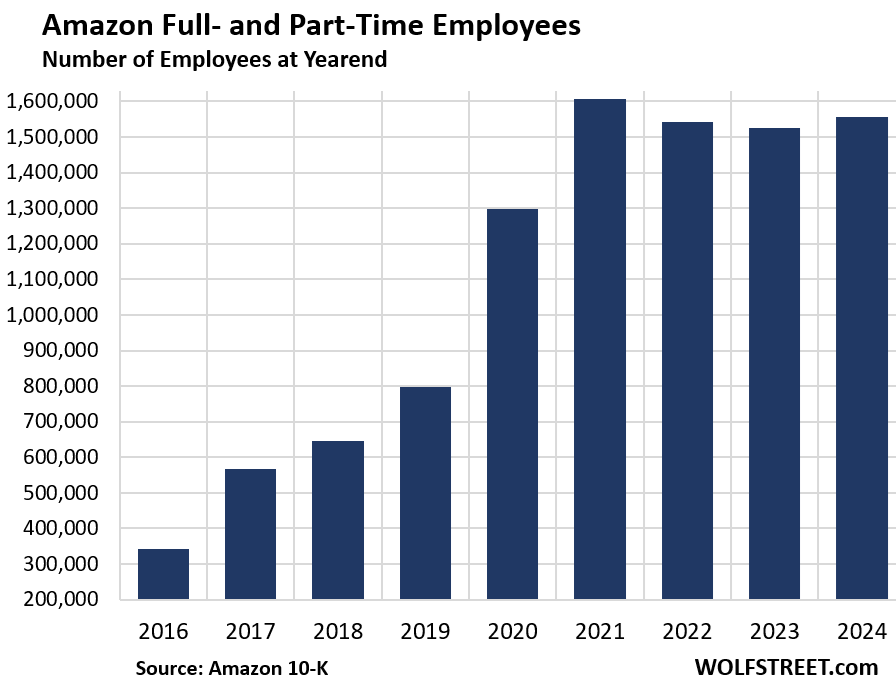

- Mid-size EVs – things that are larger than a bike and smaller than a car. Moving humans is a problem with some fundamental physics rules that I think are best served with a lighter and smaller vehicle.

- Robots + Process – I’m long on Amazon for one simple reason – they have managed to introduce process to almost every position in their company in a way that lets them get consistent results from an inconsistent and high turnover employee base. This is true on the warehouse side, the delivery side, the support side and even the tech side. Work at Amazon seems dehumanizing and now they are de-humanizing it by replacing humans with robots. They hit peak human employment in ~2021 with 1.6M and have been slowly reducing ever since. They now apparently have over 1M robots deployed in warehouses. Those numbers will flip in the next three years – we’ll have >1.5M robots and I suspect <1M employees. At that point we’ll see revenue per employee skyrocket, which likely means profit margins will increase and shareholder value will increase. Is this because robots are better than humans? No, not yet. It is because robots can be really good at specific tasks done at scale with tight process and Amazon has a culture obsessed with instituting process. That will allow them to take advantage of robots and agentic systems faster than most companies that are still chaotic and rely on really smart and flexible humans to operate them.

Tech I think is appropriately valued

- Electric Cars – the recoil we’re seeing (Tesla sales down again, Ford cancelling the F-150, etc.) is appropriate. I think we will look back at electric cars as a stepping stone towards the next thing. A good tactical step that allowed us to ramp battery production and charging infrastructure enough that other steps could be taken. New technologies are always used in a way we are familiar with and then in a new way. The electrical car minimized the disruption of someone adopting it – yes, they had to think about charging and battery life, but at least the driving, parking and vehicle registration experiences were the same. Now we have a chance to take the technology which is available at scale (electrical motors and batteries) and apply them in new ways. I don’t think the car will survive the force of innovation.

- Google’s Gen AI – I love the comeback story of Google’s Gemini (note – I used to work for Google and still own stock). I got to play around with early internal versions of the GenAI models and generally agreed with leadership that it wasn’t ready to ship externally, especially from Google, who had more to lose from it going poorly. I left the company a month or two before Nov 2022 when Chat GPT released and the whole tech world got a wakeup call. It has been great to see form the outside how they responded and Gemini 3 Pro + Nano Banana seem to be performing really well and gaining market share. The stock is up 3.5x since Nov 2022, which feels appropriate

Tech I think is overvalued

- AI Research and SOTA model companies

- There is a trend with engineers where they like projects that let them tinker with a tool that is interesting to them rather than projects that focus on solving a business problem, sometimes with boring tech. It is the whole reason the PM role was invented – to tie the projects back to business value. I see far too many AI engineers that fall in the former camp, wanting to thinker with a new things and see what is possible – they end up going to Anthropic or OpenAI. This is important in the technology improving, but ultimately very unlikely to have positive ROI. If a company can stomach the investment (Google, Meta, etc.) good for them, but too many companies have leveraged their future on a plan that very rarely works. I doubt that will work well for many of the employees (though some might be able to cash out).

- I remain of the opinion that many parts of the stack will be commoditized.

- I’m personally very bullish on the middle layer of the stack for B2B AI (Databricks – my employer) and the consumer interface for B2C AI (Perplexity, Glean and Google). There is a lot of very boring stuff that is very important – version control, evals, collaboration, etc.

Tech I believe in, but think we’re far from

- General Purpose Home robots – back in the 1960s Honeywell had the idea for a kitchen computer that could help with recipes. It was a flop, mostly because the UX was poor, it took up a lot of space in an already-tight area and it was too expensive. 40 years later the iPad came out and it has since sold nearly 1B units. Recipes are one of the major use cases for them. Honeywell was right about the need for a computer in the kitchen, but too early to build one that was worthy of adoption. I think general purpose home robots are at that point now. I am going to exclude special purpose home robots like the washing machine, dishwasher and even Roomba. Here I mean things like Neo and Optimus. I think the price point is just too high for the amount of value they add for most home owners. There will be niche cases like owners of second homes who can now spend a small fraction of their investment to have a controllable human-form there, even if only remote controlled, to take care of things that are not fully automated, like bringing in packages or turn off the water using an old manual shutoff when a leak springs. I don’t think we’ll be anywhere close to 1B sales though. Could we get there eventually? I think we can, though I’d much prefer the R2-D2 form factor and a C-3PO one.

Tech I think is close to disruption

- The Stock Market – We have reached the highest percentage of American wealth invested in equities ever at around 30%. (The rest is largely in bonds and real estate) A large part of that – I’m not able to find exact numbers – is held in stocks that trade on public stock markets. I suspect we will see that drop in the next few years and I think it is likely it never reaches this height again. The stock market provided many good things; liquidity for company owners, diversification for wealth holders, regulatory levers for governments and and huge revenue streams for investment banks and accounting firms. Over time the cost-to-benefit ratio has shifted owners. Quarterly reports are a huge burden, major shareholders who work at the company don’t have immediate liquidity anyways due to the requirement for 10b5-1 Trading Plans, a new story can tank the price and employee morale/productivity, etc. Then there is the rise of meme stock trading in which a highly motivated and irrational group of non-professional investors can steer the price away from fundamentals. This is bad, because we prefer it when only highly motivated and irrational groups of professionals can do that.

- We’re already seeing a bit of this shift away from the stock market. The 100 largest publicly traded companies have valuations of $109B+. There are 7 privately held companies that have valuations in that range. The 500 largest publicly traded companies have valuations above $15B, and there are 48 private companies with that kind of valuation.

- Being private comes with many benefits – one is lower employee distraction. I speak from experience as I now work for one of those 7 privately held companies with over $100B valuation and I previously worked at one of the seven largest publicly traded companies. Stock price swings could happen at any point and if those were >3%, it tended to cause a stir among employees, with everyone re-checking their equity. Maybe some people are disciplined enough to not check the price day to day, but I found it hard to resist. I enjoy it much more to be working at a private company where the valuation tends to only change once or twice a year. When that happens, I can spend a few hours digesting the news, adjusting contributions and tax things and then get back to work.

- But what about liquidity? The company can still raise money and do tender offers for employees periodically – we’ve seen a few companies to this and I suspect we will see more.